What is a DTC company?

Direct-To-Consumer (or DTC) companies manufacture and ship their products directly to buyers without relying on traditional stores or other middlemen. This allows DTC companies to sell their products at lower costs than traditional consumer brands, and maintain end-to-end control over the making, marketing, and distribution of products.

The initial idea behind DTC companies was to be “digitally native” by utilizing mobile and digital channels instead of traditional brick-and mortar stores to drive sales. Keeping in line with the idea of digitizing consumer experiences, DTC companies often leverage a strong social media presence to increase brand awareness. DTC companies often focus on only one product or category which makes them more specialized, and they also pride themselves on providing curated customer experiences.

What does the industry look like?

The DTC model started out for products that are easy to ship such as cosmetics, fashion, consumer goods, and household products. Now, the industry has expanded to include more products such as vehicles, furniture, mattresses, as well as genetic and fertility tests to name a few.

As of now, 40% of manufacturers in the US follow the DTC model. A study by eMarketer forecasts that DTC e-commerce sales will grow by 24% and amount to $17.75 billion in 2020. Moreover, DTC e-commerce buyers are forecasted to grow in number and increase spending. By 2022, DTC e-commerce buyers are projected to reach a milestone of 103.4 million.

Research Objective:

This study was conducted to understand:

1) Where consumers are buying mattresses in the US and what is motivating them?

2) How are brands performing through the brand funnel over time?

3) How do DTC brands stack up against more established brands?

Target Group:

– n = 500 per wave

– 18 – 70 years old

– US residents

– Must have purchased a mattress

– Primary purchase decision-makers of mattresses

(Wave 1 = August 2019, Wave 2 = November 2019, Wave 3 = August 2020)

Key Insights:

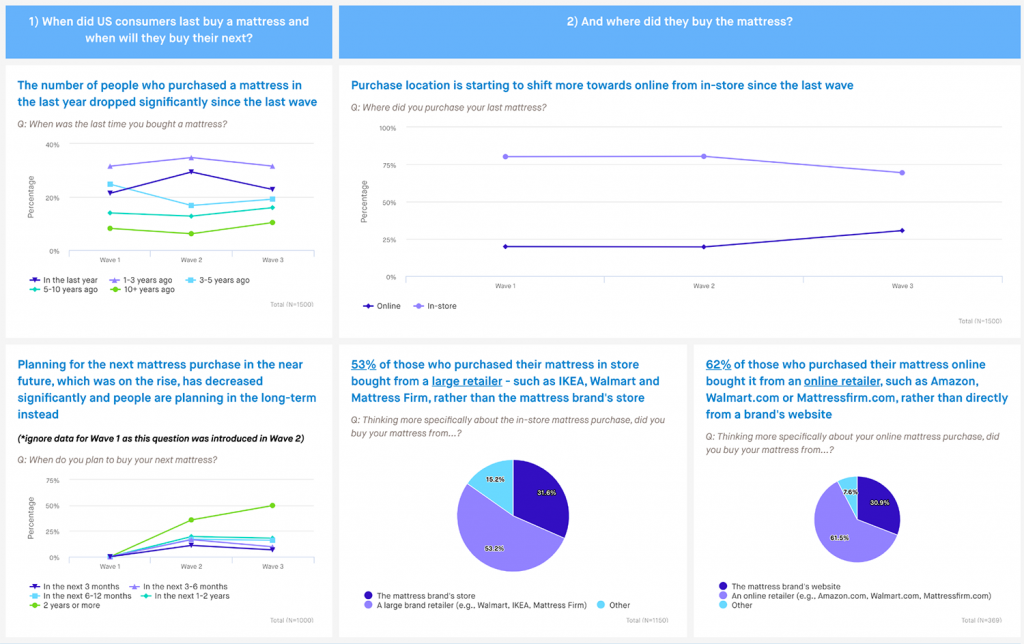

1) There is a gradual shift to an increase in online purchase with a corresponding decrease in in-store shopping.

2) People are de-prioritizing mattress purchases in the near future and are starting to think more long-term.

3) Purchasing from large retailers is still the more popular option than purchasing from the mattress brand’s store or website.

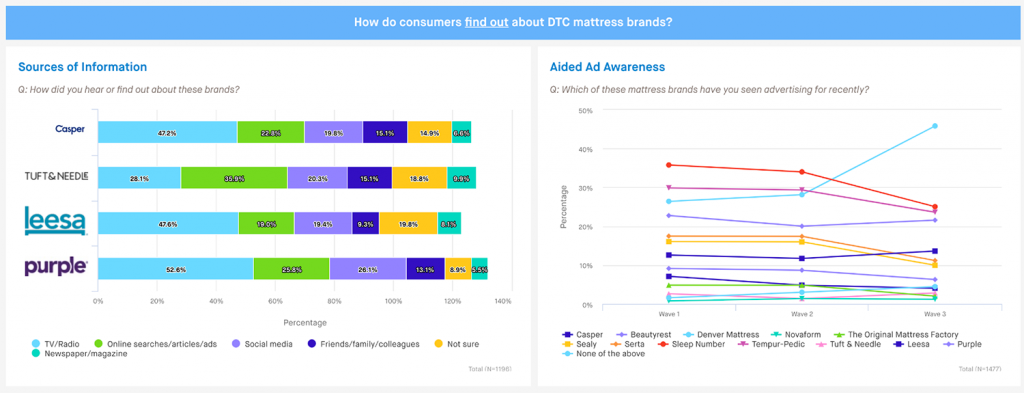

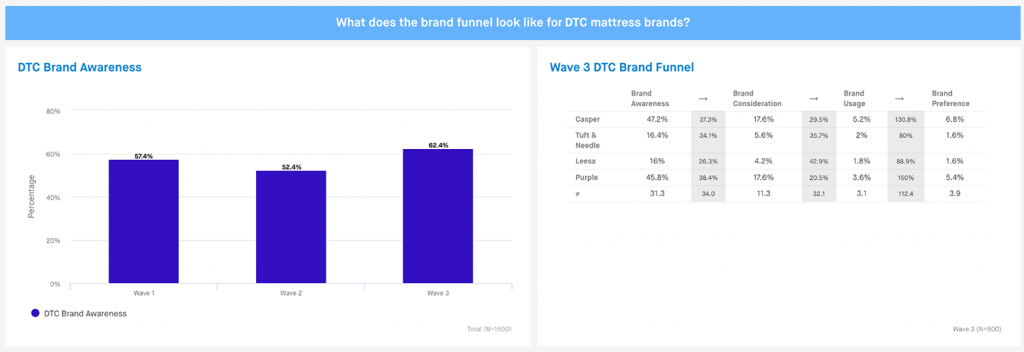

4) While established brands such as Sealy, Serta, and Tempur-Pedic are still in the lead, DTC brands are slowly on the rise as DTC brand awareness increased by 10% between Wave 2 and Wave 3.

5) Casper emerged as the leading DTC brand with a meteoric increase in aided awareness as well as the strongest metrics for consideration, usage, and preference in the DTC category.

DTC Considerers vs People Who Consider Regular MattressesPercentage26.1%26.1%81.1%81.1%12.0%12.0%DTC ConsiderersRegularN/A0%25%50%75%100%Total (N=1500)

More DTC considerers made their online purchase through the brand’s website than people who considered regular mattress brands.Percentage40.0%40.0%29.7%29.7%55.2%55.2%61.7%61.7%4.8%4.8%8.6%8.6%The mattress brand’s websiteAn online retailer (e.g., Amazon.com, Walmart.com, Mattressfirm.com)OtherDTC ConsiderersRegular0%25%50%75%Total (N=314)

More DTC considerers made their in-store purchase at a large brand retail store than people who considered regular mattress brands. Percentage29.4%29.4%31.0%31.0%63.3%63.3%54.3%54.3%7.3%7.3%14.7%14.7%The mattress brand’s storeA large brand retailer (e.g., Walmart, IKEA, Mattress Firm)OtherDTC ConsiderersRegular0%25%50%75%Total (N=1022)

Key Recommendations:

1) Brands need to continue monitoring the relationship between online and in-store shopping to see if the shift in purchase behaviours is circumstantial or a long-term trend.

It is possible that going forward, online and in-person store experiences become more interconnected instead of one experience completely rendering the other obsolete. Hence, brands need to start thinking about leveraging both channels for optimal results.

2) DTC brands need to monitor changes in how consumers plan their future mattress purchases and will need to find ways to adapt to the long-lasting effects of covid-19 accordingly.

3) DTC brands should focus on forming partnerships with more large retail brands with existing customer bases instead of building up brand-specific stores to not only target DTC considerers, but also to increase awareness and reach a wider range of audience.

(https://hbr.org/2020/03/reinventing-the-direct-to-consumer-business-model)

4) DTC brands need to position their ad dollars on Millennials. This segment is much easier to identify and target via digital channels than offline, but offline advertising is still an important channel to reach this audience.

While TV and radio continues to be the leading source of information, brands should adopt a mixed marketing strategy and start prioritizing other channels such as online searches/articles/ads and social media as well.

5) DTC brands need to measure their brand diagnostics over time and allow this to guide their marketing strategy.

It’s vital to understand how top and bottom funnel marketing initiatives are affecting brand funnel metrics, particularly as more established brands continue to hold strong market share but also more DTC brands join the market.

I) What are the current behaviors within the mattress category?

A little over half of US consumers have bought their last mattress in the last 3 years, with the majority of buyers going in store to purchase.

Compared to 45% in the last wave, only 18% of consumers are looking to purchase their next mattress in the next year.

Consumers are far more likely, both online and offline, to purchase their mattress through a large retailer,than at a specific brand store.

For brands, this means their strategy needs to involve showcasing their mattress portfolio through large retail stores both in-store and online.

II) What are consumers looking for in a mattress?

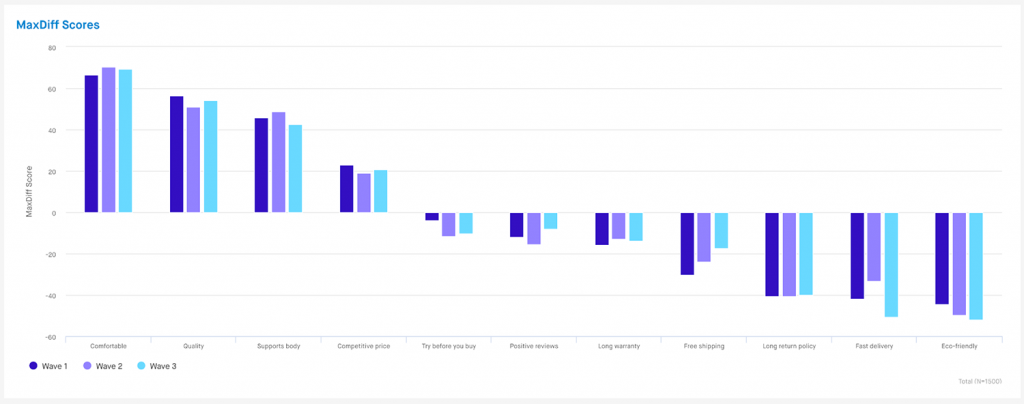

Consumers find comfort, quality and support of a mattress far more important than pricing and the purchase journey (e.g., reviews, trials, shipping, warranty) in their purchase decision.

However, consumers placed more importance on attributes such as positive reviews and free shipping in this wave as compared to Wave 2.

III) How do brands perform in the category over time?

When consumers were asked to recall a brand spontaneously, Serta was the most common brand recalled by 45% of consumers. However, both Sealy and Casper saw big increases in unaided brand awareness.

Additionally, Casper saw a 16% increase in aided awareness since the last wave, and other DTC mattress brands such as Tuft and Needle and Purple saw increases as well.

Sealy, Serta, and Tempur-Pedic convert the most consumers to consideration, usage and preference.

Casper was the only brand within the category that saw significant increases in funnel metrics between waves.

IV) How do emerging DTC brands measure up versus more established brands? What are their opportunities?

While DTC brands are still not as popular as more established brands, the category has seen some advancements since the last wave. Awareness for at least one DTC mattress brand went up from 52% during the last wave to 62% this wave.

Casper saw a big increase across all metrics of the brand funnel for Wave 3 in comparison to Wave 2. Tuft and Needle and Purple also saw big increases in brand awareness, but have potential for improving consideration and preference.

Majority of the people who consider DTC mattresses are Millennials, and are also more likely to consider purchasing a mattress online than non-DTC considerers.

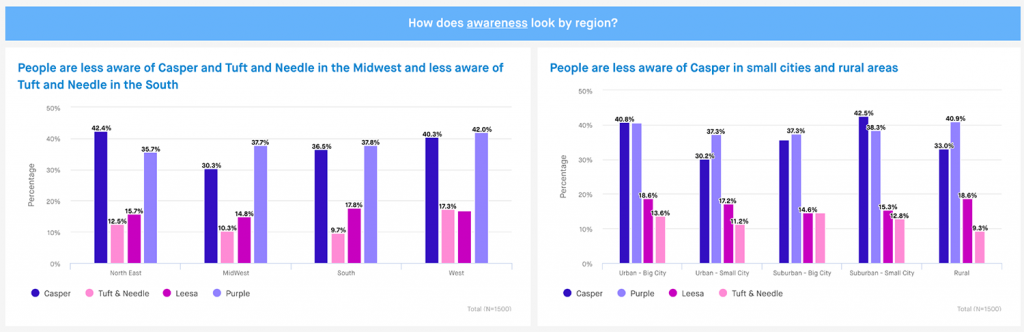

Awareness for DTC brands for the Northeast and the West remains on par. However, there is room for improvement in the Midwest and the South for Casper and Tuft and Needle. Awareness for Casper is also lower in urban small cities and rural areas.

Casper, Leesa, and Purple heavily focus on TV/Radio advertising while Tuft and Needle leverages an almost equal split between TV/Radio advertising as well as online searches/articles/ads. Purple has the biggest focus on social media advertising compared to the other DTC brands.